what is defaulting?

Defaulting is the failure of a borrower to meet the legal obligations of a loan agreement, most commonly by missing scheduled repayments of principal or interest for a specified period. When a borrower defaults, the lender gains the right to take corrective actions outlined in the loan contract, which may include penalties, legal action, or recovery of pledged collateral.

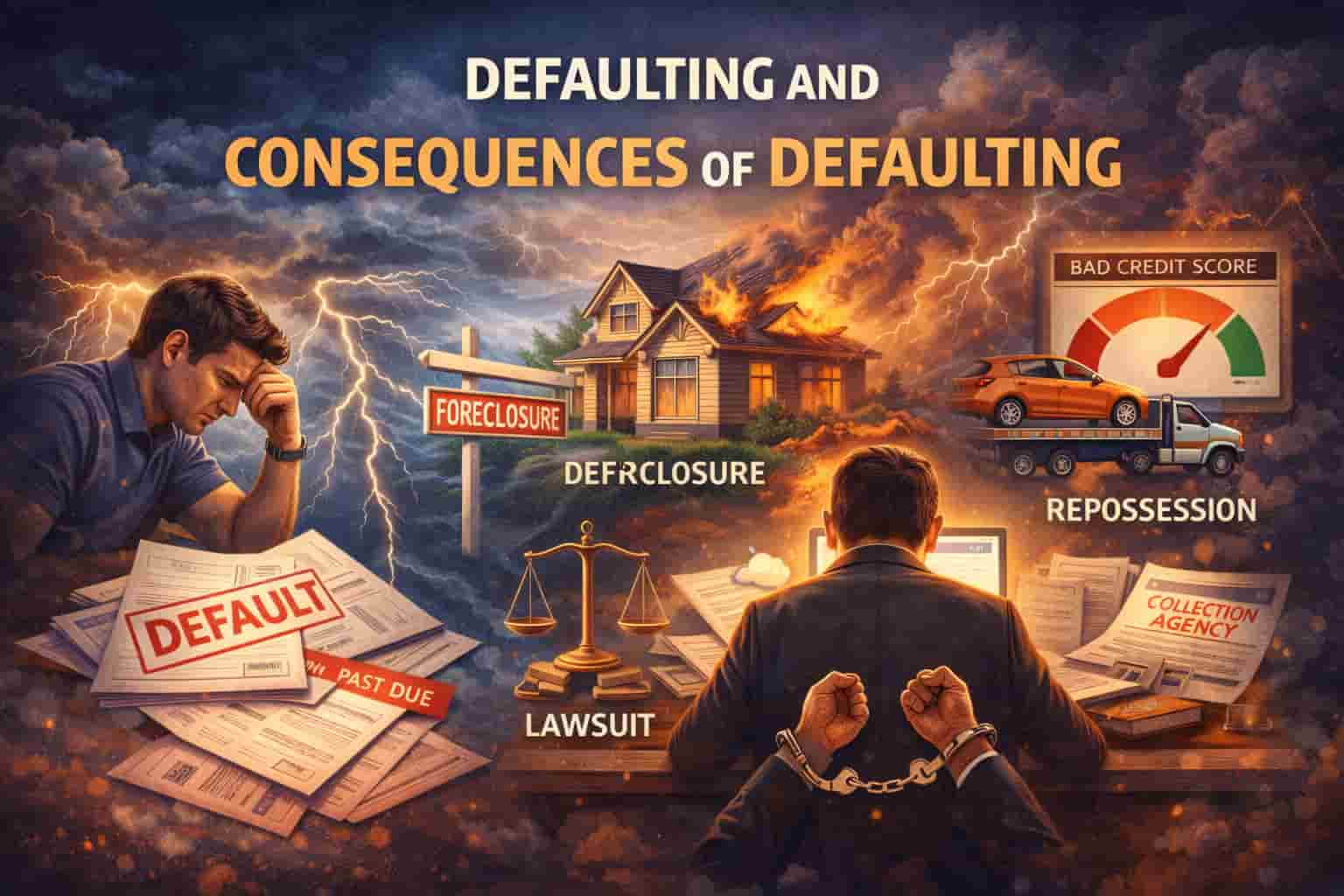

The Consequences of Defaulting as a Borrower

Borrowing plays a vital role in personal and business finance, enabling individuals and organizations to meet immediate needs, invest, or grow. However, borrowing comes with responsibility. When a borrower fails to honor repayment terms, the consequences of defaulting can be severe, long-lasting, and far-reaching. Understanding these consequences is critical for making informed financial decisions and protecting long-term financial stability.

- Damage to Credit History and Credit Score

One of the earliest and most significant consequences of defaulting is the negative impact on a borrower’s credit profile. Lenders report missed payments and defaults to credit bureaus, which can drastically reduce credit scores.

A poor credit score makes it difficult to:

Secure future loans or credit facilities

Access competitive interest rates

Rent property or pass financial background checks

In many cases, the effects of a default remain on a credit report for several years, even after the debt is settled.

- Increased Financial Costs

Defaulting often triggers additional costs beyond the original loan amount. These may include:

Late payment fees

Default penalties

Higher interest rates (especially on variable-rate loans)

As these charges accumulate, the total debt burden increases, making repayment even more challenging and potentially trapping the borrower in a cycle of debt.

- Legal Action and Debt Recovery

When informal recovery efforts fail, lenders may pursue legal remedies. This can involve:

Court judgments

Wage garnishment (where applicable by law)

Freezing of bank accounts

Legal proceedings not only increase financial strain through legal fees but also expose the borrower to reputational and emotional stress.

- Loss of Collateral and Assets

For secured loans such as mortgages, car loans, or asset-backed business loans defaulting can lead to repossession or foreclosure. The lender has the legal right to seize and sell the pledged asset to recover the outstanding debt.

This can result in:

Loss of a home, vehicle, or business equipment

Disruption to personal life or business operations

Often, the sale of the asset may not fully cover the debt, leaving the borrower still liable for the balance.

- Limited Access to Future Financial Opportunities

A history of default signals high risk to lenders, employers, and even business partners. As a result, borrowers may face:

Rejection of future loan applications

Requirement for guarantors or collateral

Higher insurance premiums

For entrepreneurs, defaulting can restrict access to business funding, slowing growth or forcing closure.

- Psychological and Social Impact

Beyond financial consequences, defaulting can take a heavy emotional toll. Borrowers may experience:

Anxiety and stress

Loss of confidence

Strained personal or professional relationships

Financial distress often affects productivity, decision-making, and overall well-being, compounding the negative effects of default.

- Broader Economic Implications

At a macro level, widespread loan defaults can weaken financial institutions and reduce lending activity. This can slow economic growth, increase unemployment, and reduce overall financial confidence demonstrating that defaulting affects not just individuals, but the broader economy as well.

CONCLUSION

Defaulting as a borrower is not merely a missed payment it is a serious financial event with lasting…consequences. From damaged credit and legal action to asset loss and emotional stress, the effects can follow a borrower for years. Responsible borrowing, clear financial planning, and early communication with lenders during financial hardship are essential steps in avoiding default and maintaining long-term financial health.

REFERENCES

World Bank Group – Credit Reporting and Financial Consumer Protection

International Monetary Fund (IMF) – Household Debt and Financial Stability

Investopedia – Loan Default: Definition and Consequences

Central Bank of Nigeria (CBN) – Consumer Credit Guidelines and Risk Management Frameworks

Experian & Equifax – Understa