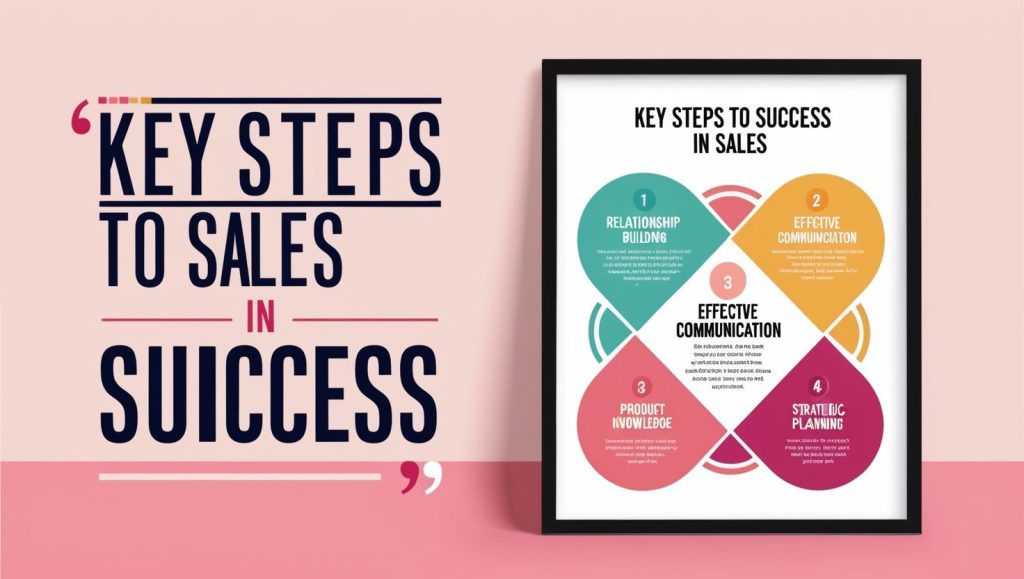

HOW TO ACHIEVE SUCCESS IN SALES

HOW TO ACHIEVE SUCCESS IN SALES This is the realization that success is a learnable skill not just luck or innate talent can be completely transformative. Here are the key takeaways from Brian Tracy: 1. Success is a Science, Not Luck Many people assume top performers are “naturals,” but most follow a proven system. If […]

HOW TO ACHIEVE SUCCESS IN SALES Read More »