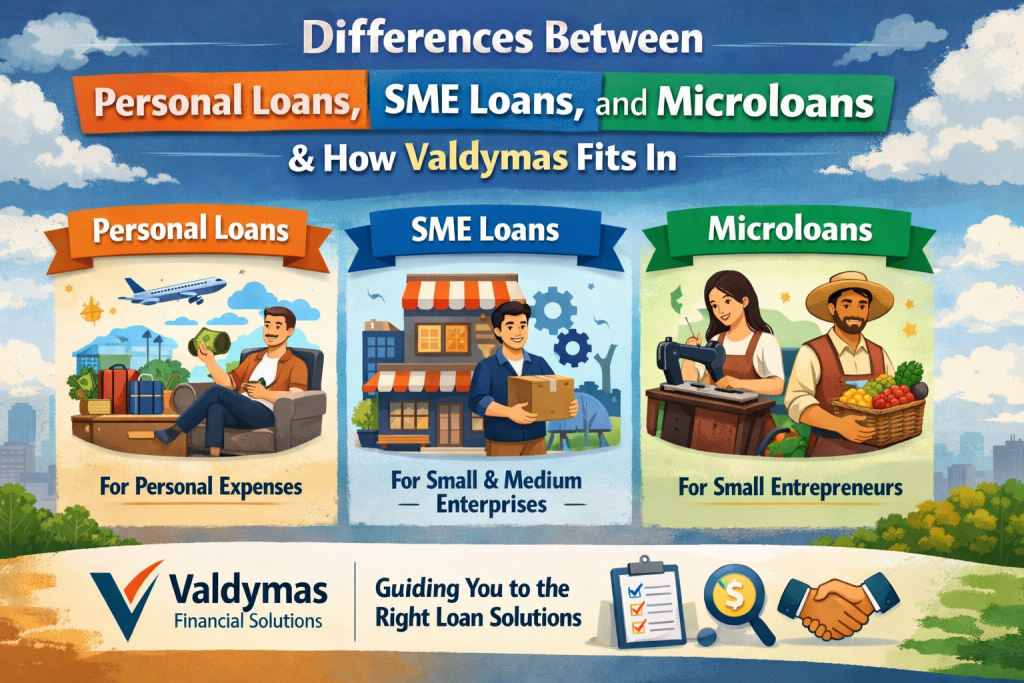

Difference Between Personal Loans, Sme Loans, And Microloans And How Valdymas Fits In

Difference Between Personal Loans, Sme Loans, And Microloans And How Valdymas Fits In Access to finance is one of the biggest drivers of personal stability and business growth. But not all loans are the same. Understanding the difference between personal loans, SME loans, and microloans can help individuals and entrepreneurs choose the right financial solution. […]

Difference Between Personal Loans, Sme Loans, And Microloans And How Valdymas Fits In Read More »